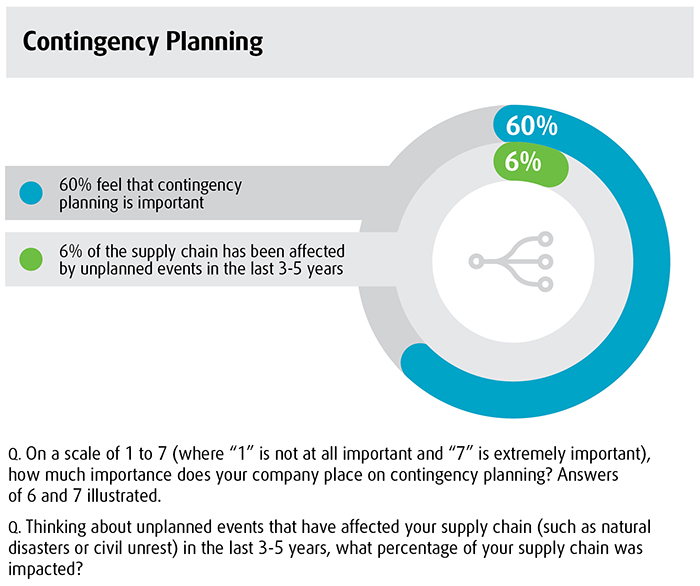

Contingency planning is a vital part of business strategy, but it doesn’t seem to be a high enough priority on the part of healthcare logistics executives, according to a recent survey of healthcare supply chain decision makers. In fact, 40% of healthcare logistics executives do not have a sense of urgency when it comes to contingency planning, reveals the eighth annual UPS Pain in the Chain report. Although most established companies may be prepared for frequent disruptions that have a smaller effect on the supply chain, they are a bit more challenged in the area of dramatic disruptions. It is the high-impact, low-probability disasters (such as the 2010 Eyjafjallajökull volcanic eruptions that disrupted international flights or Hurricane Sandy in 2012) that are generating concern.

Although it is not possible to plan for every scenario, medtech logistics and supply chain professionals can’t do it alone. They should engage in scenario planning and leverage their supply chain partners (including those on the transportation, manufacturing and materials side) to create “what-if” scenarios, advises Robin Hooker, director of healthcare marketing at UPS. From there, they should be able to create a model and can then move forward by disrupting it and running tests on their supply chain to more effectively prepare for disaster. “Partner with your supply chain and logistics partners, run scenario exercises and partner with the purpose of developing a network of distribution that isn’t necessarily reliant on your own warehousing and infrastructure, or your own transportation sourcing,” says Hooker. “Create a network that has resilience in it.”

Regulatory Compliance and Product Security Improves

The survey revealed plenty of progress in the area of regulatory compliance and product security, thanks to a higher level of IT investment, which has historically been a best practice for addressing supply chain concerns. As far as handling product security, 75% of respondents reported a high level of success, which was a 20% jump over 2014. Of these folks, 67% cited IT investment, including bar coding and serialization, as contributing factors. “IT addresses a lot of issues simultaneously by tackling regulatory compliance, product security and inventory optimization issues,” says Hooker. You really get a better feel on how to manage cost, you have more visibility and analytics, and it opens up big data as well.”

There was also an increase in year-over-year improvement in tackling regulatory compliance, with 70% reporting success versus just 57% last year.

However, regulatory differences in emerging markets pose a threat to North American companies as they try to tackle overseas infrastructure issues and other regional regulatory idiosyncrasies. Hooker sees a trend toward companies aligning with global distribution firms that have the capability to access markets by either renting warehouse distribution space and/or leveraging local transportation expertise. “You’re able to facilitate growth, but at the same time maintain an agile and nimble footprint in terms of your human resources, assets and balance sheet,” he says.

Supply Chain Cost Management a Problem

Only half of respondents considered themselves successful in the realm of supply chain cost management, citing the following obstacles in managing overall costs:

- 56%: Rapid business growth

- 55%: Fluctuating fuel cost

- 49%: Fluctuating raw materials cost

- 47%: Increasing regulatory requirements

- 45%: New market expansion

- 42%: Investments in technology

- 38%: Aging IT systems

- 38%: Lack of visibility

As medtech companies juggle expansion into new markets, rapid business growth, and the hurdles in navigating various regulatory environments and requirements, plans to better manage supply chain costs should involve strategic partnerships, says Hooker.

“There’s been a lot of consolidation in healthcare, with 2015 being a banner year for M&A activity,” says Hooker. Combined with merging supply chains and a desire to access emerging markets, medical device companies are being pulled in several different directions. In addition, companies are outsourcing innovation for medical device development, according to Hooker. “They’re looking at smaller firms that are more agile and acquiring them,” he says. “At the same time, firms are plugging into supply chain integrators that have medical device, pharma and biopharma capabilities that are unique to those [respective] areas.”

The ability to either look at a collaborative supply chain model, or partnerships in some cases, is emerging as a top strategy. “We’re seeing 57% of respondents leveraging L&D [logistics and distribution] collaborative models; 55% are leveraging a supply chain optimization analysis; 51% are plugging into IT solutions,” says Hooker. “Looking for the expertise and pulling it in rather than building it in on your own is a good strategy.”

The survey creates opportunity for device companies to have internal conversations in several areas. It’s important for companies to take advantage of partners that can help rather than try to tackle the more complex supply chain issues on their own, advises Hooker. “We’ve had discussions with firms in the device sector; we’ve talked about the lack of visibility as the supply chain moves into the last mile and the fact that they’re economizing on using a poor-quality transportation carrier that doesn’t provide a lot of visibility, and what that means in terms of risk to sales and risk to relationships with their surgeons,” says Hooker. He adds that manufacturers should examine the survey results in the context of their own supply chain and market decisions as well as emerging opportunities in new geographies.

About 420 healthcare logistics executives participated in the survey, which was conducted between April and June of this year. Their locations spanned across 16 countries.