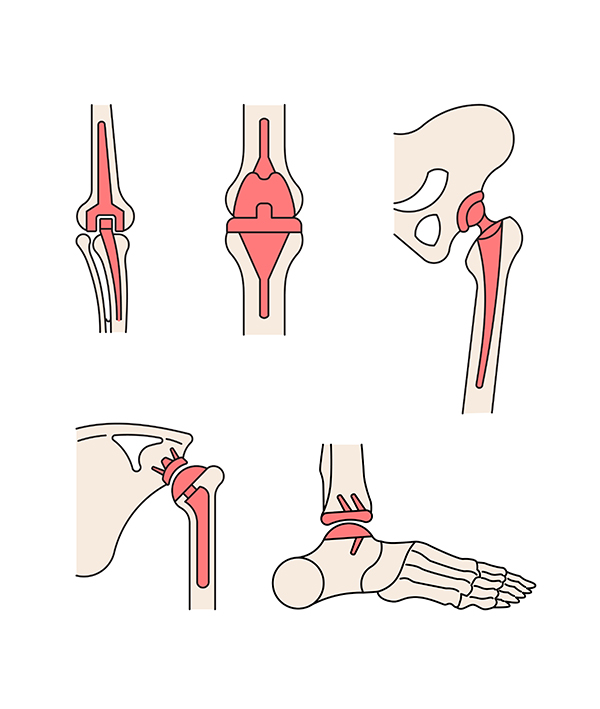

A notable uptick in the incidence of orthopedic injuries and musculoskeletal disorders means that the global joint reconstruction devices industry will witness significant growth prospects over the next few years. The prevalence of osteoporosis and osteoarthritis is a major health concern across the world, especially among older individuals. With hips, knees, ankles, and shoulders getting replaced more frequently, the number of specialty care centers offering joint replacement procedures is increasing.

High success rates and technological advances are among the main factors behind the heightened awareness about and the preference for different joint replacement surgeries. The demand and popularity of these procedures will only increase with an aging global population, a widespread occurrence of bone-related disorders, and the rise in sports injuries and accidents.

In terms of the annual valuation, the global joint reconstruction devices market size is projected to surpass $25.3 billion by 2027. Some of the world’s most prominent companies including Medtronic, Stryker, Zimmer Biomet, Smith & Nephew, DJO Global, and Globus Medical are part of the competitive landscape in the market.

This article discusses a few major ongoing trends and developments in the industry.

Advent of New, Technologically Advanced Shoulder Replacement Solutions

Shoulder replacement has emerged as an effective option for those living with chronic pain from osteoarthritis and other conditions, especially when nonsurgical treatments have failed. Recent advances in implants and surgical techniques provide hope for patients beyond pain and restored function.

Shoulder replacements will account for a fair share of the joint reconstruction devices industry by 2027. It is estimated that about 200,000 Americans undergo shoulder related surgery for torn rotator cuffs. Completely torn rotor cuffs usually require join reconstruction procedures.

The manufacturers of joint reconstruction devices are focusing on expanding their portfolio to include advanced shoulder replacement technologies. Earlier this year in January, for instance, Smith & Nephew had concluded the acquisition of the extremity orthopedics business of Integra LifeSciences for $240 million. The deal helped Smith & Nephew strengthen its shoulder replacement and upper and lower extremities offerings. A new shoulder replacement system that the company aims to launch next year is also part of the acquisition.

The advent of advanced, emerging technologies such as 3-D printing, robotics and augmented reality (AR) is making shoulder reconstruction safer, more accurate, and more efficient. Quoting a recent instance, Medacta recently collaborated with the Dartmouth-Hitchcock Medical Center to create the NextAR Shoulder application that will offer intraoperative guidance to surgeons. NextAR is apparently the industry’s first AR-enabled application for total shoulder replacement approved by the FDA. The application also received CE marking for shoulder, knee and spine surgery applications in May.

The joint reconstruction devices market forecast will certainly benefit from such technological innovations that make these procedures safer and more reliable.

Continuous Developments in Ankle Replacement Procedures

The number of ankle replacements has been constantly on the rise for a number of reasons, be it old age, accidents or sports injury. People with severe arthritis account for a substantial share of the population undergoing ankle replacement surgery.

Healthcare device manufacturers are emphasizing the addition of newer technologies to their portfolio. Stryker unveiled a range of new medical devices, including a total ankle replacement device, at the American College of Foot and Ankle Surgeons Vegas Scientific Conference held in May 2021. The company’s portfolio comprises orthopedic products designed by Wright Medical, which Stryker had acquired last November.

In recent years, numerous advanced joint reconstruction devices for the lower extremities have been introduced in the market. The Apex 3D total ankle replacement system launched by Paragon 28 in May is one such instance. The firm had also introduced the Silverback Posterior Plating System, a robust ankle fusion plating offering, November 2020. The system, according to the company, supports three distinct approaches: Lateral, anterior and posterior.

3-D Printing Gains Momentum in Joint Reconstruction Devices Market

3-D printed implants and ligaments have the benefit of providing more suitable and customized joint replacement solutions, especially where completed reconstruction is needed. The technology can help create replacement devices that will reduce operating time, improve recovery, avoid post-surgical risks like infection when produced using bio-based materials, along with ensuring durability.

The technology is emerging as a promising technology for ankle replacement surgery devices, as it aids in reducing post-operative complication and taking surgical outcomes to the next level. The Miami Orthopedics and Sports Medicine Institute is offering total ankle replacement surgery using an innovative 3-D printing technology that could be a potential gamechanger for people with advanced ankle osteoarthritis.

The FDA-approved Talus Spacer is a patient-specific 3-D printed implant used to replace the affected talus. The cutting-edge surgical procedure serves as an alternative to ankle fusion surgery, which reduces motion joint in the joint or eliminates it altogether. The surgery has the potential to avoid amputations for patients who experience rare cases of bone death around the ankle joint.

A few months ago, Boston Orthopaedic and Spine started offering Equinoxe Stemless Shoulder implant, which is a 3-D printed solutions for people needed shoulder reconstruction surgeries. The product is termed as a bone-conserving prosthesis suited for anatomic should replacement and can deliver long-term fixation to the recipient’s bone.

Joint reconstruction devices market trends are certainly driven by the expansion of component production technologies as well as the acceptance of surgical procedures among those affected. Be it the adoption of 3-D printing of implants or development of AR-powered tools, the availability and reliability of knee, shoulder, hip and other joint replacement procedures has jumped. The inevitable occurrence of age-related health issues and high number of injuries worldwide will sustain the development rate of reconstruction devices and surgical equipment.