The medical device and diagnostics industry is driven by innovation, yet the 70% cross-industry failure rate indicates that most novel ideas are unsuccessful in practice. While the rewards of an innovative medtech product are lucrative, market entry typically requires high upfront investment, and consequently, a high risk in case of market failure.

Imagine the example of a medtech company that developed a groundbreaking water cutter for surgeons, a radical innovation in its field. The electrosurgical device had the capability to dissect via a water jet with varying pressure. Despite the valuable features of tissue selectivity, reduced blood loss, shorter operation times and reduced costs, surgeons did not accept the device, and the innovation flopped.

How could this happen? The most typical shortcomings of innovation failure are:

- Poor knowledge of customer needs

- Suboptimal pricing strategy

- Insufficient knowledge of the competition (including product differentiation)

- No consideration of country specifics

- Lack of investigation into the future market

To avoid such product failures in the end, it is important to focus on the beginning. By assessing the attractiveness of a market or idea before developing and launching a concrete product, the pre-analysis helps medtech companies ensure a return on investments in innovation.

The Pre-Analysis Approach to Medtech Success

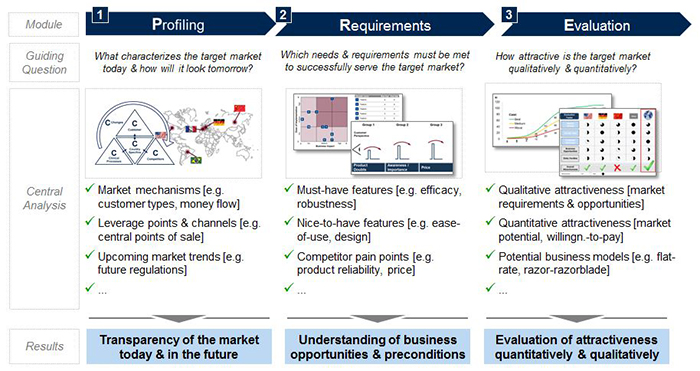

The pre-analysis consists of thoroughly profiling a market’s current as well as future structure, mechanisms and central players, identifying requirements for successful market entrance, and performing an evaluation of the market revenue potential and overall attractiveness (see Figure 1). Together, all three elements create the transparency required for making an informed and sophisticated go or no-go decision on product development and market entry.

In order to complete each step, the pre-analysis process combines primary qualitative and quantitative research (e.g., market expert interviews) with secondary sources (e.g., scientific literature, market reports)—the more direct the method, the better.

Each of the steps and what they consist of will be explained in detail in the remainder of this article.

Step 1: Profiling

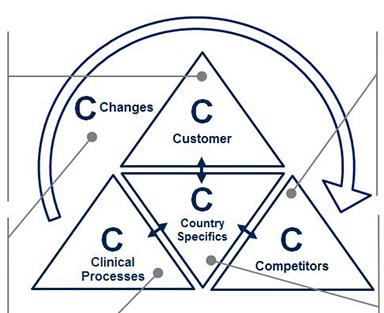

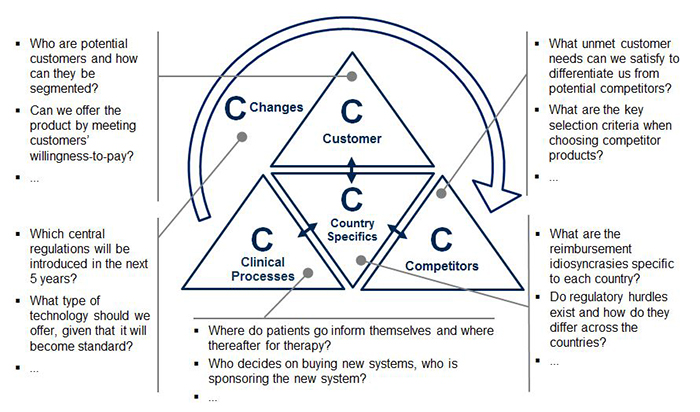

Precise market profiling allows for full market comprehension and transparency, in turn allowing for more accurate planning, especially as new product development progresses. To guide the profiling, the 5C framework (Customers, Competitors, Clinical Processes, Country Specifics, and Changes) provides an organized structure for evaluation (see Figure 2). Each C contains key questions to be answered in the pre-analysis for decision making on market entry and product development. Valuable sources are market expert interviews as well as analysis of secondary sources, such as market reports, scientific literature, and company and industry association websites.

- Customers may be characterized by their type and market potential. For medtech companies, customers are often grouped according to stakeholders: Hospitals, labs, physicians, health insurers, patients and others. Once identified, it is essential to categorize these stakeholder groups into sub-types. For example, what types of hospitals might be interested in the medtech product? How do these hospital types differ from one another? How many of each hospital type exist and which medtech devices do they normally use?

- Competitors and their product portfolios may be evaluated through identifying their strengths and weaknesses, as well as their individual products. Charting competitors’ products on a single matrix (e.g., with “target customer types” and “customer need fulfillment” as dimensions) helps to identify white spots or unmet needs in the market for potential entry.

- Clinical processes are crucial to proactively identify high potential customers and their medical device needs. The simplest way to analyze those is to start at the beginning of the patient flow and map their journey (e.g., first information source, diagnosis location, therapy location and monitoring location) in order to discover relevant buying centers within the previously defined customer groups. By outlining the key clinical process steps within the different customer groups, companies may easily recognize areas for improvement to boost consumption. For example, if the customer is a hospital, who uses the device, where, for what and how frequently?

- Country specifics may have a major influence on the local success of medical products. As a medtech company, recognizing the differences among potential target countries is key. The wide array of healthcare providers and insurance plans in one country alone may affect many aspects of product development, such as product features, local services and pricing. A Chinese blood donor center, for instance, tests blood samples for a different set of antigens than a Brazilian donor center. Therefore, within this “C”, the business landscape and economic framework governing the market will be classified as well as the technological benchmarks and expectations in each respective country.

- Changes in the market may manifest in positive or negative trends that affect a specific medtech area or the healthcare industry as a whole. To identify these trends, primary and secondary data research will bring objectivity. For example, through researching literature on in-vitro diagnostics technology, companies may find that immunodiagnostics will remain the standard for endocrine testing in the next years; however, molecular diagnostics is expected to quickly gain shares in the oncology field. Therefore, recent market developments and disruptive changes will be identified and their potential to impact the market evaluated, allowing for an early planning of potential counteractions.