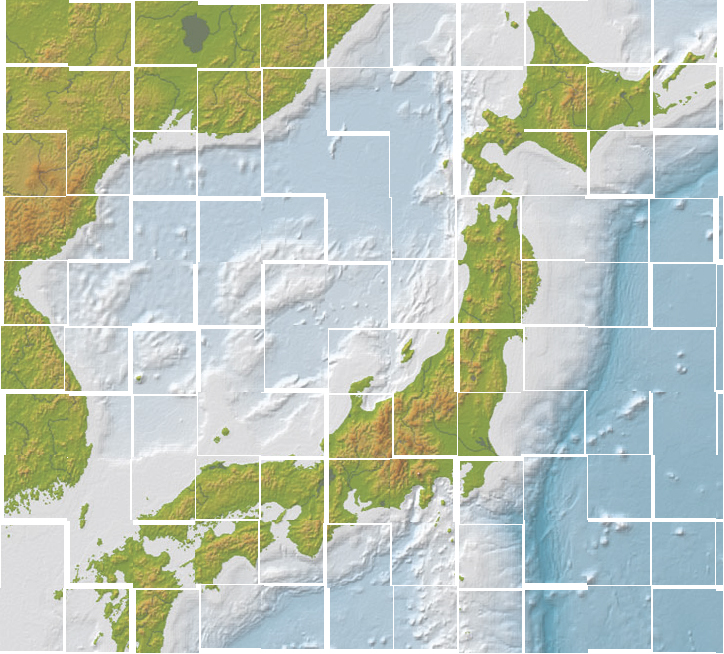

Government healthcare expenditures in Asian countries has been increasing steadily in recent years. According to a 2016 Deloitte report, the average annual increase in government healthcare spending in Asian countries is more than 6%, compared to 4.5% in the United States and less than 1.5% in the European Union. The Japanese government remains the top healthcare spender in the region. In India and China, annual healthcare expenditures are increasing by approximately 16% and 9%, respectively. However, data from the World Health Organization (WHO) show that overall healthcare spending per capita remains low in India and China compared to other Asian countries. Increases in Asian healthcare spending are often times aimed at dealing with cancer, including improving early detection and diagnosis services, reducing out-of-pocket treatment costs, and providing newer therapies.

Cancer in Asia is becoming more prevalent and deadly. The WHO estimates that more than 4 million people died from cancer in Asia in 2016. In China, cancer is the leading cause of death and there are four million new cancer patients diagnosed every year, equivalent to roughly 12,000 people per day. Likewise, cancer is the leading cause of death in South Korea, and there are more than 200,000 new cancer cases a year. While not the leading cause of death in Japan, cancer still accounted for more than 400,000 deaths in 2016. Worldwide cancer incidence continues to increase, and experts estimate there will be more than 10 million cancer cases in Asia by 2030, compared to 2 million cancer cases in the United States.

The rise in cancer cases and deaths can be attributed to lifestyle and demographic changes. With age, the risk of developing prostate and other types of cancer rises. Countries that have aging populations, like Japan and South Korea, have experienced a dramatic increase in the number of prostate cancer cases. Additionally, factors like poor diet and low levels of physical activity also lead to a higher risk of certain types of cancer, such as breast, stomach and esophageal.

Lung cancer prevalence is particularly high in Asia, largely due to high tobacco usage. However, even in countries like South Korea where smoking rates are decreasing, lung cancer incidence remains high. Research indicates that besides smoking, poor air quality and cooking oil fumes may contribute to the continued high rates of lung cancer in Asia.

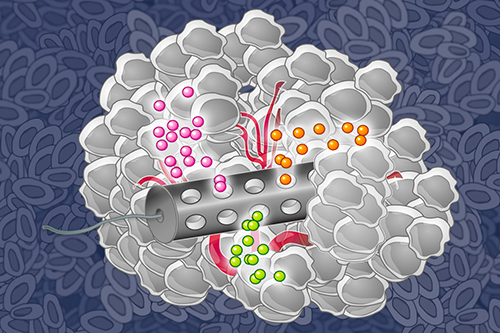

The increase in cancer patients has resulted in growing demand for the latest cancer devices and drugs. Proton therapy is becoming more popular worldwide, including in Asia. Proton therapy is thought to be less damaging than traditional radiation, as the radiation can be delivered to very specific areas. The method is able to target cancer cells, causing less damage to the surrounding healthy tissue.

Ion Beam Applications S.A. (IBA), a company based in Louvain-La-Neuve, Belgium, is a leading provider of proton therapy and has secured deals in many Asian countries. In June 2015, IBA and Philips Healthcare agreed to provide proton therapy systems to India’s Apollo Group at the Chennai hospital and Tata Memorial Center. In September 2015, South Korea’s National Cancer Center announced the installment of IBA’s pencil beam scanning (PBS) system. In December 2016, IBA’s proton therapy system, ProteusONE, received regulatory approval from Japan’s Pharmaceuticals and Medical Devices Agency (PMDA). IBA also signed a contract with Taiwan’s Tomorrow Medical Systems Co. Ltd. to install a second ProteusONE system.

IBA will also install a proton therapy system in China, having signed a contract with Concord Medical Services Holding Ltd. in 2016.

Another proton therapy manufacturer, Varian Medical Systems (based in Palo Alto, California), will install its ProBeam system at Hefei Ion Medical Center (HIMC). HIMC will be China’s first government-owned proton center and is expected to be operational by the end of 2018. Like IBA’s ProteusONE, Varian’s ProBeam uses PBS, which allows for precise treatment of tumors that are next to critical organs or have irregular shapes.

ViewRay, Inc. is another successful medical company in Asia. Based in Oakwood Village, Ohio, ViewRay manufactures the MRIdian system, a cancer treatment that combines both MRI and radiation. In recent months, two hospitals in Japan have purchased the MRIdian system. The first system is expected to be operational in the first half of 2017. ViewRay’s first international MRIdian system was installed at Seoul National University Hospital in September 2015.

Pyrexar Medical, headquartered in Salt Lake City, Utah, also installed two of its HyperThermia systems in Korean hospitals at the end of 2015. HyperThermia uses therapeutic heating to treat cancer. Therapeutic heating also attempts to destroy cancer cells while minimizing damage to surrounding healthy tissue. HyperThermia damages oxygen-deprived cancer cells with a low pH. Healthy cells do not have these two characteristics and are left undamaged by the therapeutic heating.

Accuray, Inc., located in Sunnyvale, California, has also succeeded in the Asian medical device market. In December 2016, Hong Kong Sanatorium & Hospital (HKSH) signed an agreement with Accuray to acquire three Radixact Systems to upgrade HKSH’s CyberKnife M6 System. Radixact is Accuray’s latest helical radiation therapy technology and their first systems only started treating patients in early December 2016. Upon installation, HKSH will become the first hospital in Asia to offer both the Radixact System and CyberKnife M6 System.

In addition to installing medical devices and technology in Asian hospitals, Western companies are also working with Asian companies to develop new treatments. On September 29, 2016, Intuitive Surgical of Sunnyvale, California announced a $100 million joint venture with Shanghai Fosun Pharma Co. Ltd. Intuitive Surgical will work with the Chinese firm to make robotic products to tackle lung cancer. The joint venture will be based in Shanghai, where both the research and development and manufacturing of the products will take place.

Cancer will continue to be a major healthcare issue in Asia. As governments increase their healthcare spending, the demand for cancer diagnostic tests and treatments will also increase. These dynamics provide plenty of opportunities for foreign medical device companies looking to increase their business in Asia.