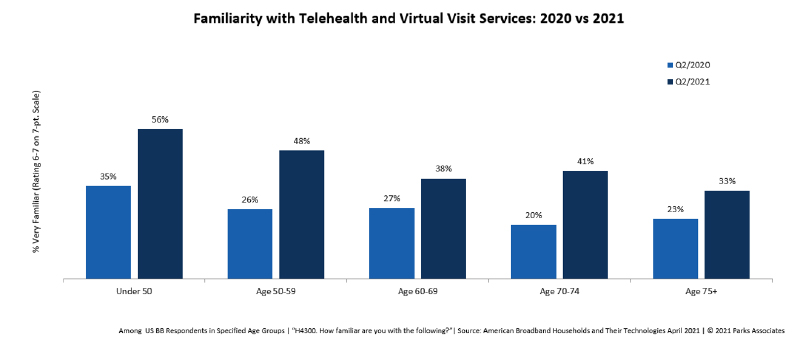

Since 2019, telehealth usage has surged among seniors. As of Q2 2021, 42% of those age 65+ reported using a telehealth service in the past 12 months. Different age groups use different modalities. Video calling is proportionately higher among older consumers, in contrast to historic fears. Many seniors now report that they are familiar with telehealth and virtual visit services; familiarity has risen since 2020.

During the COVID-19 pandemic, telehealth service channels changed dramatically—many more consumers access virtual care from their local primary care provider. Over the past two years, consumers have primarily interacted with local physician’s practices during virtual consultations. This is a dramatic shift from the pre-pandemic norm, wherein telehealth services like AmWell, Teladoc, Doctor on Demand, HealthTap, MDLive and others were the dominant channel for services. That said, many of these lead telehealth networks form the backbone of services provided by other players, such as hospital systems, pharmacy brands, and insurers.

Older respondents are far more likely to rely on telehealth services provided by a local physician. The shift from national to local telehealth services is connected to greater use among older adults. This is consistent with our findings across multiple years that older consumers strongly prefer local physicians and health systems.

Among those under 35, national and local services are more comparably used. Telehealth service providers with a direct-to-consumer strategy are best served targeting younger consumers to grow their user base. Older consumers are less likely to pay for telehealth visits out of pocket than younger consumers, and much more likely to have their visit completely reimbursed.

The move by CMS to have virtual care visits reimbursed for their population has helped to fuel the dramatic increase in adoption among seniors.

Top Six Drivers of Remote Care

1. Reimbursement changes: Over the past two years, CMS has made substantial changes to support virtual care reimbursement, including expanded reimbursement of telephonic evaluation and management visits as well as behavioral health services. Physicians now receive reimbursement for remote patient monitoring services provided via a third-party vendor under a physician’s general supervision. CMS also instituted payment parity to pay practitioners at the same rate as similar in-person services.

2. Regulatory changes: CMS waived limitations on the types of clinical practitioners able to offer telehealth services to Medicare patients and suspended requirements around originating sites (i.e., the location from which a telehealth patient can receive care), so that Medicare beneficiaries can now receive telehealth services inside their own homes. It added 135 additional allowable services that could be delivered via telehealth, which more than doubled its service list.

3. New funding: The CARES Act of 2020 allocated $200M of funding for telehealth to support the expanded use of these tools. Funding in the private sector is also at an all-time high. Digital health incubator Rock Health reports that the first half of 2021 surpassed all of 2020’s funding, which was itself a blockbuster year for digital health funding.1 In addition, the bipartisan Choose Home Care Act of 2021 would allow for Medicare beneficiaries to recover at home following a hospitalization with extended at-home care, rather than a skilled nursing facility.

4. Staffing shortages: Despite vaccinations being widely available in the United States, vaccination rates have slowed. As a result of COVID-19 variants, a new surge of infections have occurred, further exacerbating staff shortages and hospital capacity issues. A desire to reduce infection spread continues to fuel the demand for virtual care.

5. Device innovation: Health devices — both medical-grade and consumer-oriented — are becoming more capable and accessible, expanding the possibility of virtual care models and empowering consumers with more insight into their own health status. While these technologies help advance applications and insights as a result of the ability to capture vital signs, it is still critical for devices to demonstrate alignment with accepted vital sign standards, like Polysomnography (PSG), the current gold standard for measuring sleep. In the future, it’s expected that more and more manufacturers will look to clinically test health devices against these set standards.

6. Consumer demand: Consumer familiarity with telehealth services is increasing across all demographics. While the average telehealth user is 44 years old and likely to have children in the home, telehealth use has increased substantially across all demographic groups.