The task of targeting, segmenting and engaging medtech customers has grown much more complex with eroding physician autonomy and the rise of non-clinical stakeholders. The traditional volume-centric approach isn’t up to the task. A more holistic approach, incorporating new data sources and measures of value, is needed to differentiate in today’s purchasing environment.

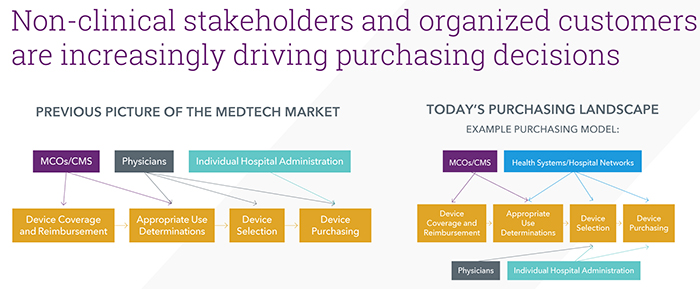

Today medtech companies are operating in a very different purchasing environment than they were a generation ago. The shift to value and the wave of consolidation that has coursed through the U.S. healthcare industry have moved the locus of decision-making power in hospitals and health systems upstream. Where the physician was king, today’s medtech customers are many, including patients as well as non-clinical stakeholders like hospital administrators, procurement experts and payers, and an alphabet soup of organized customers (e.g., IDNs, ACOs, MCOs and GPOs).

As a result, medtech commercial organizations must account for a much more complex web of influencers on purchasing, each with their own unique information needs. To optimize deployment and realize shorter sales cycles, companies must identify not just what facilities and physicians are associated with the highest sales volumes, but which customers are actually driving purchasing decisions within key accounts. Further, they must understand what types of information and measures of value matter to each of these stakeholders, as their customers weigh tradeoffs of clinical efficacy, costs and outcomes.

The following outlines what medtech commercial leaders need to know in order to navigate this complex ecosystem.

Identifying Key Accounts and Customers

- Which accounts should you prioritize? Purchase and procedure volumes remain important in identifying and segmenting key accounts, but a raft of other factors matter, too. Understanding the interplay between network affiliation, referrals and reimbursement dynamics, in addition to volume, can help us identify and profile key opportunities and inform commercial strategy. Based on these considerations, we can place accounts within an opportunity matrix to flag those with potential for growth and expansion, those where market share must be maintained, and those which can safely be relegated to the back burner.

- Who holds decision-making power within your accounts? At some hospitals, even within larger systems or IDNs, physicians retain a measure of autonomy over purchasing decisions, or can champion a device or procedure in their facility’s Value Analysis Committee (or Purchasing Committee, Technology Assessment Committee, etc.). In others, purchasing power has been centralized. Most sit somewhere on a spectrum running from physician autonomy to top-down procurement. So if there are 10 accounts in your territory and half of them roll up into an IDN, where purchasing power is concentrated at the top, it will be far more efficient to speak to the decision-makers at the IDN rather than individual facilities.

Demystifying your stakeholders and the influences driving them requires looking beyond traditional CMS claims data to a larger, richer selection of data from CMS and commercial sources, including purchasing, affiliations, epidemiology and EHR data, clinical trials, social analytics, publications and conference engagements (to name a few).

Demonstrating Value to Your Stakeholder

- Who are the patients and what is the commercial context? Understanding the patient population served and placing that in the context of the underlying market dynamics can be essential in constructing a value case. Facilities seeing a high number of older, sicker and poorer patients may find the case for an innovative heart valve more persuasive—but when operating in crowded and undifferentiated categories lacking in standout innovators, they’re likely to be making purchasing decisions chiefly based on economic value.

- Which measures matter to each stakeholder? While physicians continue to prioritize product features and clinical benefits in weighing purchasing decisions, non-clinical stakeholders are concerned with economic value, clinical outcomes and the patient experience. These considerations may vary widely by geography and practice type. Commercial leadership should ensure that their messaging speaks to these information needs and value drivers.

Meeting Stakeholders Where They’re At and Giving Them What They Need

- How can reps and account managers maintain relationships when in-person customer engagement is vanishingly hard to come by? A multichannel approach, inclusive of email and virtual visits tailored to the communication preferences of each stakeholder, can help extend reps’ reach when customers are too busy to see them. Customizing content and messaging according to audience segment can help to ensure relevance and nurture those relationships further.

- Where can commercial teams upgrade their offerings to stakeholders? While many physicians and non-clinical stakeholders find value in paper reprints and other hard copy handouts from reps, multimedia elements such as videos and digital budget modeling tools can liven up presentations and enhance engagement, whether shared in in-person meetings or through remote communication. Some commercial organizations are experimenting with more advanced digital tools such as virtual reality experiences that let stakeholders see where the capital equipment goes or give them a deeper perspective on the device.

Many medtech companies are already grappling with these changes, and trying to transition to a more modern approach, a few having already assembled dedicated units focused on non-clinical stakeholder engagement. But there’s a lot of inertia within any commercial sales organization. “We’ve always done it this way,” medtechs may tell themselves, or “Hey, we’re meeting our targets, and if it ain’t broke, don’t fix it.” The danger, as we move further into a world where purchasing is driven by value and decisions happen increasingly higher up the food chain, is that organizations will gradually see their market position erode, first gradually, then suddenly. Over time, weaker customer relationships and sales resourcing inefficiencies will yield smaller deals, decreased pipeline velocity and lower revenues.

Conversely, enhancing your reps’ hard-won knowledge base through a data-enabled approach to account targeting ensures that you’re maximizing your sales dollars and, coupled with deft change management and the right KPIs in place, can put you at a competitive advantage in the long term.